Embarking on the Journey to Homeownership

Welcome aboard, future homeowner! You are about to set sail on an exciting journey towards owning your very first home. The road to homeownership may seem daunting at first, but with the right guidance and resources, you will soon find yourself navigating the world of first-time homebuyer Loans with ease.

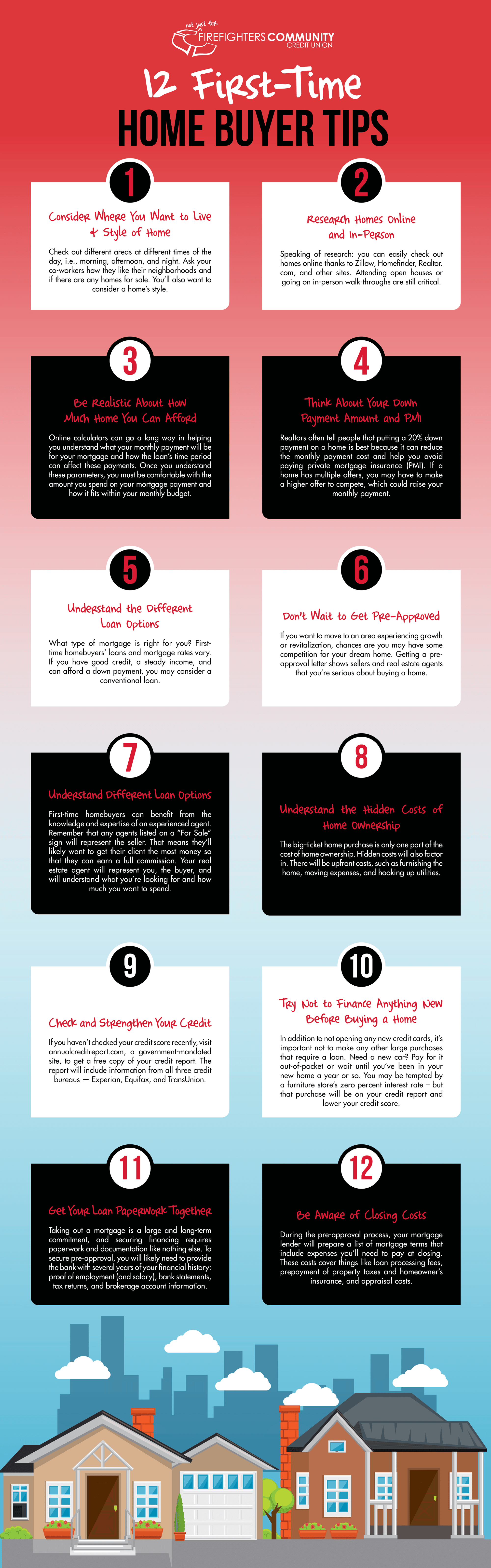

As you embark on this journey, there are a few important things to keep in mind. First and foremost, it is essential to have a clear understanding of your financial situation. Before you start searching for your dream home, take the time to evaluate your budget, credit score, and overall financial health. This will not only help you determine how much you can afford to spend on a home, but it will also give you a better idea of the type of loan you may qualify for.

Once you have a good grasp of your financial situation, it is time to start exploring your options for first-time homebuyer loans. There are a variety of loan programs available to first-time homebuyers, each with its own set of benefits and requirements. From FHA loans to VA loans to USDA loans, the possibilities are endless. It is important to do your research and compare different loan programs to find the one that best fits your needs.

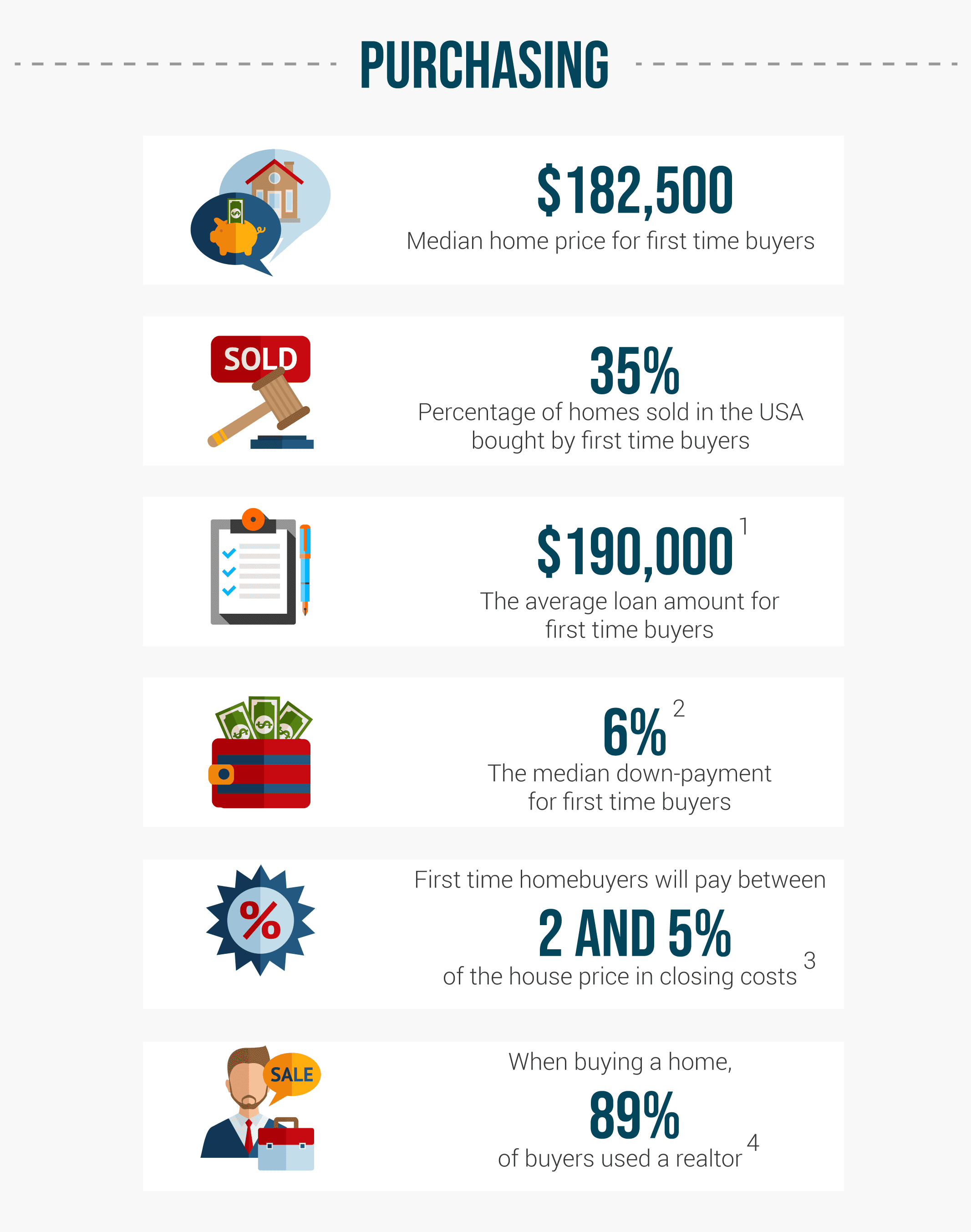

When it comes to choosing a loan program, one of the key factors to consider is the down payment requirement. Many first-time homebuyer loans offer low or no down payment options, making it easier for you to afford your dream home. Some programs even offer assistance with closing costs, making the homebuying process more affordable overall.

In addition to the down payment, it is important to consider the interest rate and terms of the loan. Different loan programs offer different interest rates and repayment terms, so it is important to choose a loan that you feel comfortable with. Some programs may offer fixed-rate mortgages, while others may offer adjustable-rate mortgages. It is important to weigh the pros and cons of each option and choose the one that best fits your financial goals.

As you navigate the world of first-time homebuyer loans, it is important to remember that you are not alone. There are many resources available to help guide you through the homebuying process, from financial advisors to real estate agents to loan officers. Take advantage of these resources and don’t be afraid to ask questions. The more informed you are, the better equipped you will be to make the right decisions for your future.

In conclusion, embarking on the journey to homeownership is an exciting and rewarding experience. With the right guidance and resources, you can navigate the world of first-time homebuyer loans with confidence and ease. Remember to evaluate your financial situation, explore your loan options, and seek guidance from professionals along the way. Before you know it, you will be unlocking the door to your very first home. Happy house hunting!

Navigating the World of First-time Homebuyer Loans: A Comprehensive Guide

Ahoy, aspiring homeowners! If you’re ready to set sail on the exciting journey towards owning your first home, one of the most important steps you’ll need to take is securing a first-time homebuyer loan. In this comprehensive guide, we’ll explore the ins and outs of these special loans designed specifically for those venturing into homeownership for the first time.

First-time homebuyer loans are a fantastic option for those who may not have a large down payment saved up or who have a limited credit history. These loans often come with lower interest rates and more flexible terms, making them an attractive choice for new buyers. So, grab your compass and let’s dive into the world of first-time homebuyer loans!

One of the first things you’ll need to do when considering a first-time homebuyer loan is to familiarize yourself with the different types available. There are various loan programs tailored to meet the needs of first-time buyers, such as FHA loans, VA loans, and USDA loans. Each of these programs has its own set of requirements and benefits, so it’s essential to do your research and determine which one best suits your individual situation.

FHA loans, for example, are backed by the Federal Housing Administration and are popular among first-time buyers due to their low down payment requirements. VA loans, on the other hand, are available to eligible veterans and offer competitive interest rates and no down payment options. USDA loans are another excellent choice for those looking to purchase a home in a rural area, as they offer low-interest rates and zero down payment requirements.

Once you’ve identified the type of first-time homebuyer loan that best fits your needs, the next step is to gather all the necessary documentation. Lenders will typically require proof of income, employment history, credit score, and any existing debts. Having all of this information readily available will streamline the loan application process and increase your chances of approval.

As you begin the application process for your first-time homebuyer loan, it’s crucial to stay organized and responsive to any requests from your lender. Be prepared to provide additional documentation or answer any questions that may arise during the underwriting process. Remember, the more proactive and cooperative you are, the smoother the loan process will be.

While securing a first-time homebuyer loan can be an exciting and rewarding experience, it’s essential to be mindful of your budget and financial capabilities. Before committing to a loan, take the time to assess your current financial situation and determine how much you can comfortably afford to borrow. Consider factors such as your monthly income, expenses, and any future financial goals you may have.

In addition to securing a first-time homebuyer loan, there are several other costs associated with buying a home that you’ll need to budget for. These may include closing costs, home inspection fees, property taxes, and homeowners insurance. It’s essential to factor in these additional expenses when determining your overall budget for purchasing a home.

As you navigate the world of first-time homebuyer loans, don’t be afraid to seek guidance from a professional. A mortgage broker or financial advisor can provide valuable insight and advice to help you make informed decisions throughout the homebuying process. They can also assist you in comparing loan options and finding the best financing solution for your specific needs.

In conclusion, setting sail with a first-time homebuyer loan can be an exciting and rewarding experience for those looking to embark on the journey to homeownership. By familiarizing yourself with the different types of loans available, organizing your financial documentation, and staying proactive throughout the loan application process, you’ll be well on your way to achieving your dream of owning your first home. So hoist the sails and navigate the waters of first-time homebuyer loans with confidence and enthusiasm!