Everything You Need to Know About Personal Loans for Bad Credit

What are Personal Loans for Bad Credit?

Personal loans for bad credit are loans specifically designed for individuals who have a poor credit history. These loans are typically offered by alternative lenders who are willing to take on the risk of lending money to those with less-than-perfect credit scores.

Where Can You Find Personal Loans for Bad Credit?

You can find personal loans for bad credit from online lenders, credit unions, and even some traditional banks. Many online lenders specialize in offering loans to individuals with bad credit, making it easy to compare rates and terms from the comfort of your own home.

When Should You Consider a Personal Loan for Bad Credit?

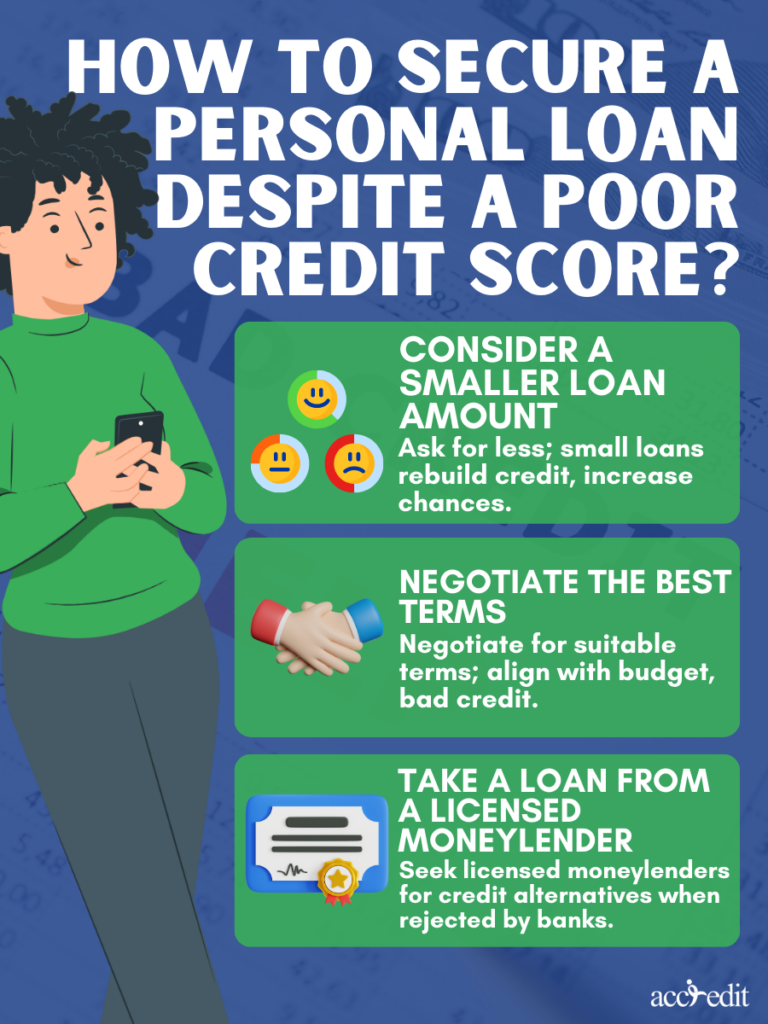

You should consider a personal loan for bad credit when you need to borrow money but have been turned down by traditional lenders due to your credit score. These loans can help you cover unexpected expenses, consolidate debt, or make large purchases when other options are not available.

Who Qualifies for Personal Loans for Bad Credit?

:max_bytes(150000):strip_icc()/are-personal-loans-bad-your-credit-score.asp_FINAL-44664c5b7c6b4d73b8ddc4699d545722.png)

Anyone with a poor credit history can qualify for a personal loan for bad credit. Lenders who offer these loans typically look at other factors, such as income and employment history, when making their lending decisions.

Why Choose a Personal Loan for Bad Credit?

Choosing a personal loan for bad credit can help you rebuild your credit history by making on-time payments and improving your credit utilization ratio. These loans can also provide you with the funds you need to improve your financial situation and reach your goals.

How Can You Apply for a Personal Loan for Bad Credit?

To apply for a personal loan for bad credit, you will need to provide basic personal information, such as your name, address, and Social Security number. You may also need to provide proof of income and employment to demonstrate your ability to repay the loan.

Conclusion

Personal loans for bad credit can be a useful financial tool for individuals who have struggled to qualify for traditional loans due to their credit history. By understanding what these loans are, where to find them, when to consider them, who qualifies, why to choose them, and how to apply, you can make informed decisions about your borrowing options.

FAQs

1. Can I get a personal loan for bad credit with no credit check?

While some lenders may offer personal loans for bad credit without a traditional credit check, these loans often come with higher interest rates and fees.

2. How much can I borrow with a personal loan for bad credit?

The amount you can borrow with a personal loan for bad credit will vary depending on the lender and your individual financial situation.

3. What is the repayment term for a personal loan for bad credit?

Repayment terms for personal loans for bad credit can range from a few months to several years, depending on the lender and the amount borrowed.

4. Will a personal loan for bad credit affect my credit score?

Making on-time payments on a personal loan for bad credit can help improve your credit score over time.

5. Are there any alternatives to personal loans for bad credit?

Alternatives to personal loans for bad credit include secured loans, credit-builder loans, and borrowing from friends or family members.